When comparing how Singapore and Hong Kong have progressed thus far, Victory Securities CEO Katerine Kou made a bold assertion. “Singapore is currently the top choice [in the area] for wealthy families looking to relocate as it closes up its investment migration program by encouraging family offices.” These two Asian tigers have been arguing about which city is better for a very long time.

According to the Global Financial Centres Index in September 2022, Hong Kong ranks higher in the banking, trading, and insurance sectors. Besides, economists count some considerable potential where Singapore seems to be the natural replacement destination if foreign businesses and talents leave Hong Kong. Singapore has an almost perfect financial system and accessible English communication business environment whilst, Hong Kong is an attractive place to live and work.

Hong Kong

Hong Kong has a free market economy that is dependent on trade and finance which linked its dollar near to that of the US dollar. Besides, China, as Hong Kong’s trading partner accounts for about 50% of all local trade. Hong Kong’s cheap production costs allow for successful competition. Without exchange restrictions, its business owners can purchase raw materials on the most affordable market. They pay fewer taxes since they do not rely on the government for pricey services.

While competition has kept salaries low, it has also decreased the cost of living. Production for the domestic market has grown at a rate similar to export growth. Manufacturing of home appliances, building supplies, and food processing have all advanced quickly. As a growing additional revenue stream, crafts and artwork for tourism are flourishing. A significant portion of the construction boom is dedicated to the building of hotels and offices.

A combination of months of political and social unrest, followed by nearly three years of severe limitations brought on by the Covid-19 epidemic, have reduced Hong Kong’s appeal as a financial center.

Singapore

Singapore has a market economy and is one of the finest places to do business, most likely because of the low trade barriers. In general, Singapore is a free port. The majority of goods in Singapore—more than 99 percent—are duty-free. However, there are significant excise taxes on petroleum items, motor vehicles, and alcoholic and tobacco products. Most of these taxes are imposed due to social or environmental concerns. Except for sectors like air transportation, public utilities, newspaper publishing, and shipping, there are no limits on foreign ownership of businesses in Singapore.

Due to its open economy, Singapore welcomes foreign trade and investment. Also, the infrastructure now holds the top rank in the 2021 Infrastructure Index, moving up two spots. The city-state is rated highly as an investor-friendly tax environment and is ranked #1 across indicators of economic position, political stability, and ease of doing business. Singapore’s number of single-family offices has increased from 400 in 2020 to 700 in 2021.

Singapore has benefited from its favorable geographic location to rise to the top of the global transportation league for both air and maritime cargo. The busiest container ports in the world are in Singapore. They provide a selection of 200 shipping lines that connect to over 600 ports in 123 different countries. The rationale for having a Headquarters in Singapore:

-

- Proximity to growth markets in Asia and an entity’s home country

- Stable political and favorable tax regimes

- Support from the Economic Development Board (EDB) of Singapore

Here we will discuss the differences of the two countries based on salary, living cost, education, and business performance:

- Salary

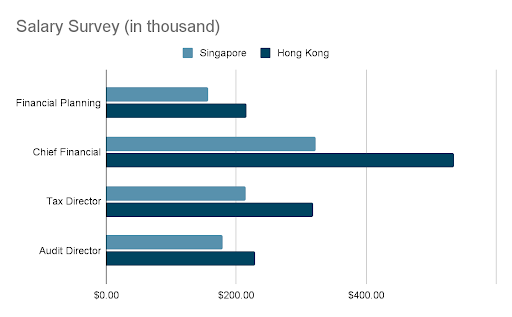

Historically, top finance positions have been paid more in Hong Kong than in Singapore, but during the past five years, the difference has significantly increased.

According to statistics collated by Bloomberg from a 2022 study by recruiting agency Robert Walters Plc, salaries for the director- and chief officer-level roles are more than 60% higher in Hong Kong. The difference in 2017 was roughly 25%.

The influence of the national security law and Hong Kong’s challenge to retain talent in the face of tight Covid restrictions are two factors contributing to the change.

The income tax rate is still quite low in both locations. The highest rate in Singapore for income over the first $230,000 is 22%. (All prices have been adjusted to US dollars.) The highest rate in Hong Kong is 17%.

Foreign Workers:

In the foreseeable future, Singapore may be more appealing to foreign businesses and talent than Hong Kong. However, Singapore’s discriminatory laws shield locals from losing their jobs. For senior professionals making more than S$30,000 per month, it will award five-year work visas under its new Overseas Networks and Expertise (ONE) pass. There are stricter regulations for hiring foreign workers, including a points-based immigration system. Employment pass holders, who are usually skilled workers, decreased from 193,700 in 2019 to 161,700 in 2021.

The sharp decline in working visa approvals—from 41,289 in 2019 to 5,701 in 1H—indicates Hong Kong’s waning appeal. Because of Hong Kong’s laxer COVID regulations, Chinese businesses might relocate there. In 1H, 92% of visa permits in the financial services sector went to mainlanders, compared to a little over 50% in 2019.

- Living Cost

The extra income will be necessary for workers who choose Hong Kong. ECA International’s statistics indicate that it is the most expensive city in the world for ex-pats for the second year in a row. It was ranked second in 2017 at the time.

| Cost of Living | Hong Kong | Singapore |

| Family Rent | $3792 | $2843 |

| Food expenses | $499 | $474 |

| Transport | $230 | $220 |

According to Lee Quane, the company’s regional director for Asia, Singapore saw price increases on things like electricity and fuel this year, but the city-declining state’s currency kept it in 13th place on the ECA list. By maintaining the purchasing power of the local currency, the peg of the Hong Kong dollar to the US dollar has helped to reduce inflation.

- Education

According to Bronwyn Small, a senior education consultant at ED-SG, a consultancy that aids families in finding placements in international schools in Singapore, the standard of education in Singapore and Hong Kong is “similar,” and some institutions run schools in both cities. In terms of IB scores, both cities outperformed the global average.

According to the International Schools Database, the median annual tuition at an international school in Singapore cost $21,000. In Hong Kong, that is equivalent to around $17,000.

- Business

According to our analysis, Singapore will make you happier, even though positions in Hong Kong may pay the most. Singapore is perceived as less flashy than Hong Kong, but it creates a stronger sense of well-being, according to our poll of about 600 people working in banking and financial services in APAC earlier this year.

Singapore stocks are more resistant to the current selloff than Hong Kong equities are. While rental growth in Singapore’s central business district accelerated for the three quarters to March 31, Hong Kong’s office rental growth and average monthly rates have remained flat so far this year. This opens an expectation that Singapore’s office market will keep benefiting from return-to-office momentum and the opening of the international border.

Job Listing: The patterns of job openings in Singapore and Hong Kong highlight their disparate fortunes and appeal to multinational corporations. Job postings in the city of Southeast Asia increased to 126,600 in June from around 50,000 at the end of 2019 as a result of relaxing Covid restrictions and border openings, which also fueled a small economic rebound. Geopolitical issues that constrain China and Hong Kong also increase business flows to Singapore, where GDP increased by 3.8% in the first quarter and by 4.4% in the second. Jobs available in Hong Kong decreased from around 63,000 at the end of the year to about 54,000 in June.

Due to the social upheaval of 2019, the National Security Law, and escalating tensions between the United States and China, several foreign companies presumably reduced their corporate presence in Hong Kong. Economic growth has been stifled by social constraints in Hong Kong, which partially align with Beijing’s Covid Zero plan.

| Hongkong | Singapore |

|

Push Factors:

|

Push Factors:

|

|

Pull Factors:

|

Pull Factors:

|

Both countries have their own pros and cons, and they will absolutely step up to become a better land for living and business. Restarting the CIES will help Hong Kong’s economy by bringing in a lot more private investors and business owners who may not be considered talents but are prepared to use Hong Kong as their “bridge” to the West.

Additionally, Singapore’s overall cost of living is still 9% less affordable than Hong Kong’s overall cost of living, despite being one of Asia’s most industrialized nations. This accounts for elements including the price of clothing, food, housing, transportation, personal care, and entertainment. Singapore was ranked first in Asia in Mercer’s 2019 annual list of the cities with the highest quality of life. With the best infrastructure in the world, Singapore is typically regarded as the best Asian city for immigrants from the West to reside in. Hong Kong was rated as Asia’s seventh-best city to live in. Finally, both cities offer excellent conditions for commercial expansion.

Feel free to contact us

if you have any inquiries!